A recent report by Goldman Sachs Research has unveiled a promising outlook for the electric vehicle (EV) market, indicating a more rapid decline in battery pack prices than initially anticipated. The report, released in early November, highlights factors contributing to this trend, such as lower metal prices, technological advancements, and improved production methods.

According to the report, the cost of battery packs for electric vehicles is expected to plummet to $99 per kilowatt hour (kWh) of storage by 2025, marking a remarkable 40% decrease from 2022 and surpassing previous forecasts by 17%. Goldman Sachs Research analysts attribute nearly half of this decline to decreasing raw material prices, particularly those of lithium, nickel, and cobalt.

Nikhil Bhandari, Co-head of Goldman Sachs Research Asia-Pacific natural resources and clean energy research, forecasts an average annual reduction of 11% in battery pack prices from the present until the end of the decade. Bhandari predicts that as a result of these falling prices, battery electric vehicles (BEVs) could achieve cost parity with internal combustion engine (ICE) vehicles by 2025, even without subsidies.

“The reduction in battery costs could lead to more competitive EV pricing, more extensive consumer adoption, and further growth in the total addressable markets for EVs and batteries,” stated Bhandari.

The report emphasizes the shifting dynamics in the EV market, indicating a move away from government-driven support to consumer-led adoption. Bhandari notes that global EV penetration is on the rise, with China potentially entering a phase of consumer-driven EV adoption.

Goldman Sachs Research analysts project a substantial increase in global battery electric vehicle uptake, estimating a jump to 17% in 2025 from 2% in 2020. The projections further indicate percentages of 35% and 63% by 2030 and 2040, respectively. In a “hyper adoption” scenario, these numbers could soar to 21% by 2025, 47% by 2030, and an impressive 86% by 2040.

China emerged as a frontrunner in the EV revolution, leading the way with competitively priced electric vehicles compared to their internal combustion counterparts. The report acknowledges the role of heavy subsidies from Chinese manufacturers, many of which are state-owned, in driving EV sales. However, the report anticipates a shift in this paradigm by the mid-2020s as battery costs decrease, leading to a significant reduction in EV prices.

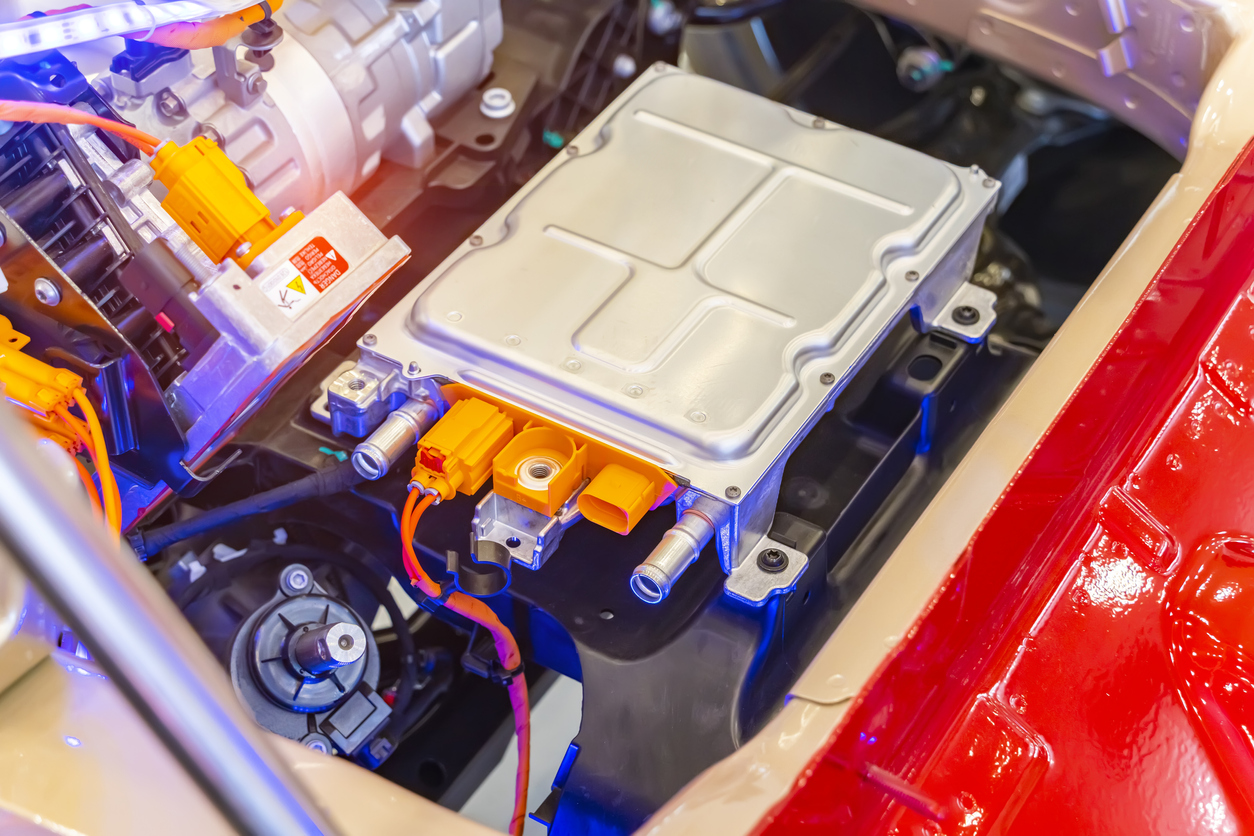

The report concludes by highlighting ongoing innovations in battery technology, including the development of solid-state batteries and novel anode materials featuring silicone. Additionally, advancements in battery structure, particularly large cylindrical types, are expected to simplify the manufacturing process, resulting in meaningful savings in labor and time.

Did you find this article interesting? Give it a ‘like’ by clicking the ‘heart’ button above!