Vehicle manufactures are reducing production across the world. What does this mean for your fleet operations?

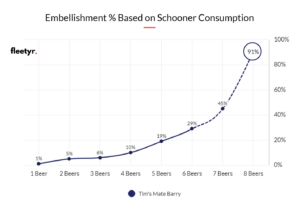

A mate recently bragged about how he sold his second-hand 2004 Hilux for $3K more than the purchase price back in 2018. Usually, this throw-away statement is something data analysts at Fleetyr don’t take seriously, particularly this friend who tends to embellish by about 19% after 5 schooners.

We thought we would look deeper into his claim and help give you some insight into the current fleet buying opportunities, threats, and the history of why we currently find ourselves in this situation.

As reported in the NY Times, Toyota will reduce production by 40%. Similarly, General Motors and Ford will be cutting production as well. This is due to a global chip shortage influenced by:

- COVID-19

- US Sanctions on Chinese chipmaker SMIC

- New product launches like the PlayStation 5 and the Xbox Series X

- Demand from cryptocurrency miners

- Drought at TSMC’s chip manufacturing plant (which uses substantial amounts of ultra-pure water to make chips)

- Fire at Renesas Electronics’ Naka Factory in Japan, which mainly produced automotive controllers

All the above has created a downturn in the automotive industry, which meant car manufactures kept making cars but couldn’t deliver them because the chips (about 1400 per vehicle) still need to be installed.

As a result, car manufacturers are holding onto an extensive amount of stock with no chips. In the short term, this will cause a shortage of supply which will cause new vehicles to increase in price marginally.

We expected to see vehicle prices rise by 3-5% based on our modelling, however with a shortage of new vehicles, the normal turnover of used stock will also dry up.

In Australia, the used car market has become a sellers’ market, with sellers now getting a significant return on a vehicle than they would have two years ago.

The data suggests that if you can get your hand on new stock now (before any prices increase), you can get rid of your old vehicles at higher-than-usual 2nd hand prices.

Furthermore, you’ll want to take asset depreciation more seriously. For fleet vehicles that are two years old or more, you’re likely to have depreciated them too much for tax purposes. Due to the great price you’ll get from a sale, there will likely be a tax burden to bear on the difference.

Is your head spinning from all this information? Reach out to the AFMA to get moving in the right direction and make the most out of your fleet!