The global automotive industry now faces an oversupply of semiconductor chips after a period of shortage after the COVID-19 pandemic. Analysts from chip manufacturer NXP Semiconductors predict a slowing demand from the industry as a whole.

MARKET SITUATION

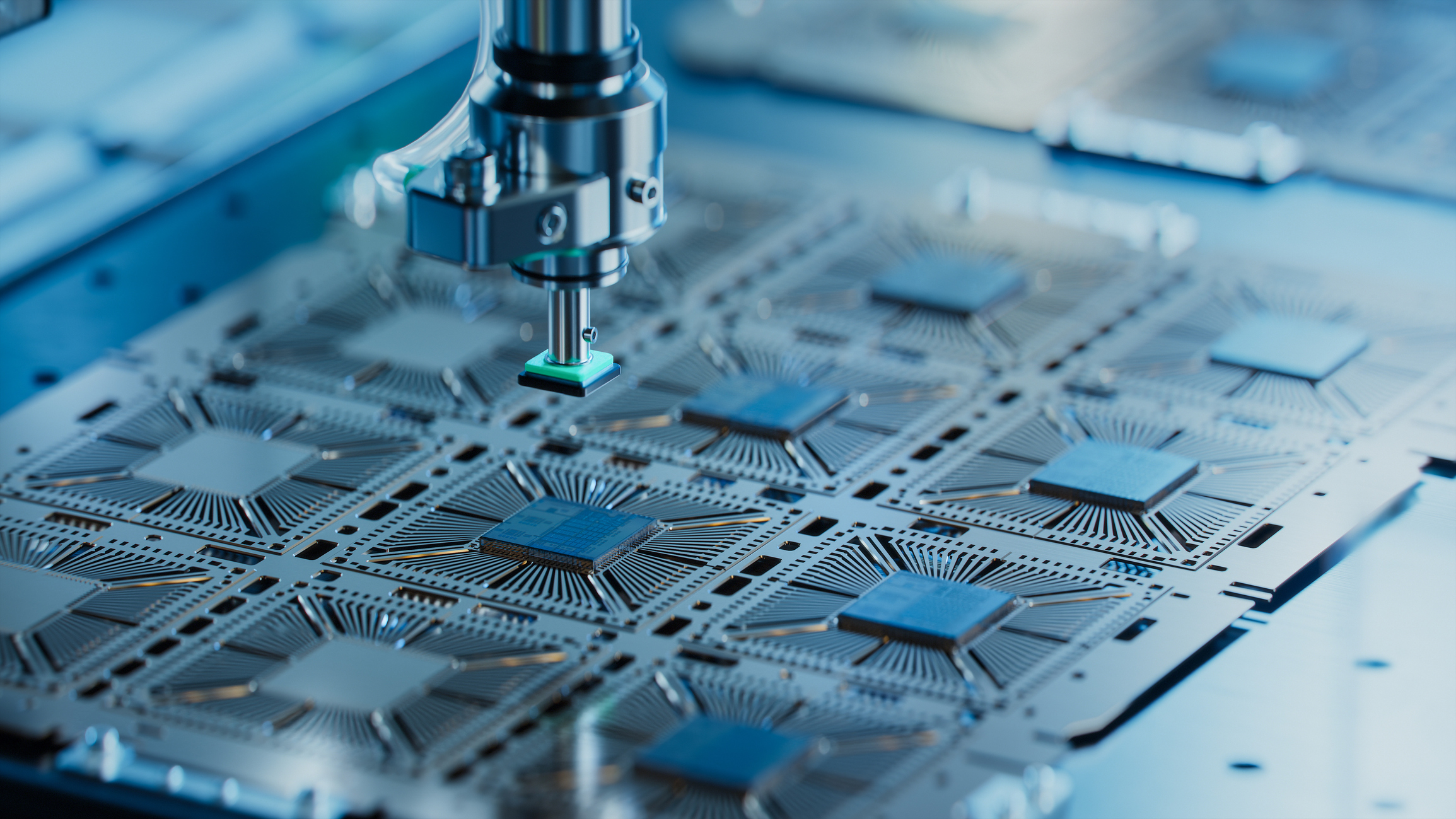

NXP Semiconductors is a Dutch company that manufactures chips and manufacturing solutions for multiple sectors including the Internet of Things (IoT), telecommunications, and automotive. In a recently published sales report, the company disclosed a 6 per cent decrease on-year in semiconductor chip consumption by the auto industry.

Similarly, electronic companies such as Geneva’s STMicroelectronics and the US’ Texas Instruments both reported declines in for the 4th quarter of 2024. The former announced a 28 per cent decline in in revenue for “digital integrated circuits and radio frequency products” due to a lack of demand for Advance Driver Assistance Systems (ADAS) and infotainment. Meanwhile, the latter saw a slight shrinkage for the auto industry as a consequence of slowing global demand.

For companies like NXP, the automotive sector is one of its biggest markets. However, despite customers worldwide making the switch from internal combustion engine (ICE) vehicles to electric vehicles (EV), potential buyers are discouraged due to higher price tags and interest rate schemes.

POST-SHORTAGE BOOM

Automakers are currently adjusting their inventories to shifting demands and trends. The global automotive sector is still reeling from a scarcity of semiconductor chips in the aftermath of the COVID-19 pandemic. The shortage lasted from 2020 to 2023, where higher demand for electronic devices was necessitated by work and study-from-home adjustments. Furthermore, global events such as the rise of cryptocurrency, natural disasters, and the impact of Russia’s war on Ukraine on the neon industry contributed to the imbalance of demand and supply for semiconductor chips.

In response, manufacturers attempted to compensate for the shortage by producing more chips. However, demand has since weakened significantly, leading in a global oversupply of semiconductor chips.

An expert from Infineon Technologies India recently acknowledged the downturn of demand for chips from the automotive industry. “We can see that many customers are reducing their semiconductor inventories. At the same time, forecasts for global vehicle production are slightly down,” said Vinay Balkrishna Shenoy, Infineon Techonlogies India’s managing director.

An executive from the Nomura Research Institute (NRI), Ashim Sharma, made the same observation. “Globally, automakers accumulated significant inventory in anticipation of sustained demand post-Covid. However, sales have tapered off over the last three to four quarters,” he said. “This mismatch between production and market demand has resulted in excess stock across the supply chain.”

Was this article informative? Leave us a like if you learned something new!